Relief for Developers as Steel Prices Ease

By KPrice of steel and steel-based items used in the construction industry has retreated following a fall in global prices of the metal due to flagging demand from China’s real estate sector.

By KPrice of steel and steel-based items used in the construction industry has retreated following a fall in global prices of the metal due to flagging demand from China’s real estate sector.

Bobby Johnson the chairperson of the Kenya Metal and Allied Sector said steel prices have gone down by about 25 percent in the last nine months, in line with the decline in global steel prices.

This is despite the shilling’s depreciation against the dollar—which raises the cost of imported goods—meaning that local buyers would have otherwise enjoyed a greater price fall of the metal.

The cheaper steel, a key commodity in the construction sector, will come as a relief to developers who have also had to contend with higher prices of other building materials including cement, timber and iron.

“In January, the price for refurbished steel bars was going at Sh130 per kilogram (kg), plus value-added tax (VAT), which has significantly reduced to Sh95 per kg. For steel tubes the price has gone from Sh160 to Sh120 in the period,” said Mr Johnson.

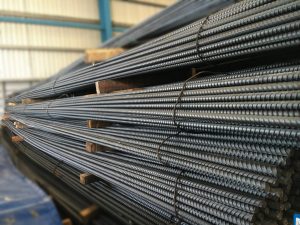

Steel is one of the world’s most important construction materials, with China being one of the key buyers of the metal from global producers.

It is used to make reinforcement bars, beams and columns, windows, and doors, among other products.

The Asian economy’s finished steel inventories as monitored by the China Iron and Steel Association (CISA) fell 7.2 percent from end-July to 25.13 million metric tonnes last month, indicative of reduced demand from the country’s real estate sector which has slowed down this year.

For local developers, the prices of some steel products had increased by up to 40 percent in the first quarter of this year, also due to a shortage that had been occasioned by supply fears related to Russia’s onslaught on Ukraine which began in February.

Russia and Ukraine account for nearly 20 percent of the global export of steel.

This saw the price of a kilo of steel go up to Sh180 by the end of March, before beginning to retreat in the second quarter of the year as global demand flagged.

This translated to higher costs for builders, some of whom had already inked contracts that factored in lower prices of the material.

Mr Johnson suggested stable policies to help the growth of the industry, which will eventually help ease volatility in prices.

“Steel is the largest consumer of electricity and the government should redirect the excess power during off-peak hours to the industry at a cheaper subsidised rate,” said Mr Johnson.

He also encouraged the production of the metal locally instead of importing it.